EDIT (March 28): Okay this blog is finished.

Most people don’t realize how F.U.B.A.R. (fucked up beyond all recognition) our Western world is about to become.

This blog article assimilates a lot of information, such as:

1. The vaccines are the bioweapons. Have been since the Spanish Flu.

2. They elite are collapsing everything on us and going to make our lives utter hell very soon. We only have a year or two left to prep.

3. Bitcoin is the Trojan horse diabolical weapon of mass destruction. Is being weaponized now.

4. Everything is being weaponized against us, including taxes, land ownership, health care, banking, the air, water, etc..

27:28 & 28:44 Kevin erroneously claims that central bank digital currency (CBDC) doesn’t present any additional threat. The current banking system incorporates considerable decentralized banker discretion, bolstered with banking and consumer protection laws. Banks being private enterprises are subject to lawsuits to which the government is untouchable. If JP Morgan closes one’s account, one might open an alternate for example at their local credit union. The threat is that other options would be terminated, thus the central bank digital currency (CBDC) would eventually be mandatory not a choice. A fully centralized, fully trusted, fully permissioned CBDC is the antithesis of a decentralized, trustless, permissionless block chain; and is a massive collectivized power vacuum that invariably would trend to tyranny.1 ← hover or click to that footnote for elaboration.

DeSantis’ proposal to ban CBDCs via the Uniform Commercial Code would either fail due to kangaroo 🦘 court challenges (e.g. Supremacy Clause, c.f. also, or interfering with interstate commerce per Article I section 8, etc.) or otherwise plausibly strangle Florida’s economy if the proposed ban is successfully enforced and if the Treasury eliminates cash along with the ongoing consolidation-centralization of the banking system. Florida doesn’t have enough time nor scale to build up a reputable, acceptable independent currency and alternative banking system.

Additionally the large corporations including retailers such as Amazon, Walmart, Lowes, Home Depot, etc. are ostensibly beholden to the obvious technocracy plan (aka “the Great Reset”) underway to enslave the population. Very likely the mafia running the U.S. government is planning recurring power grabs under the pretext of intentionally fabricated world war, plandemics, cyberattacks, EMP attack on the grid, trumped up climate change and whatever other harebrained crap the credulous sheeppl will believe (or at least genuflect to2) as pretext(s) for emergency diktat-orial power as currently enshrined in smorgasbord-myriad of technocratic statutes, including as I recall particularly onerous provisions in the revised public health law that DeSantis signed into law.

“Borrower is enslaved to the lender.” —Proverbs 22:7

“Successively ratchet the economy downhill, while bettering secured positions…Transfer asset ownership, but retain prior owners as renters where possible.”—Ishkabibble in To foretell the future, think like a banker

Stage 1: ratchet downhill, centralizing the banks

To maximize an egregiously overleveraged society’s Minsky Moment to entrap all in an Orwellian, panopticon, full centralized central bank digital currency (CBDC), do the following.

Trap the Fed in the self-immolation of simultaneously raising rates and reflation, by fostering simultaneous inflation paradoxically coupled with persistently low unemployment (a distinction from the 1970s when the Boomers were entering their prime earning years in the workforce) via accelerating socialism (via feudal diktats, rigged/stolen elections, bureaucratic overreach, kangaroo courts, etc), war (escalating WW3 to continue for several years), repeated plandemics/climate change/cyberattack emergency lockdowns (e.g. resulting in stimulus checks, looming UBI and mothers compelled to home school…all thus removed from the workforce), to force interest rates ever higher in repeating cycles of stimulus reflations.

First delay to mislead3 (e.g. lies claiming inflation will be transitory) then (to catch up to bond market) suddenly moonshot the Fed Funds rates (offered in Fed facilities) to trap unwary banks in a bank solvency crisis that eventually centralizes (i.e. consolidates) all of society’s deposits at the Fed.

Elon Musk tweeted that by hiking again they’re just exacerbating the potential bank contagion. Thus clearly the plan is premeditated exactly as I’m pointed out herein this blog. They’re (intentionally) centralizing the banking system.

Powell might attempt the justification (a pretext excuse that was fabricated intentionally as well) that their hands are tied because inflation is still too high so they’re trying to thread a needle by both reflating (to bailout their premeditated bank contagion) with their balance sheet while fighting inflation with Fed funds rate hikes. Yet per the video clip above, he’s tongue-tied when asked to explain why they didn’t instead employ increased reserve ratios for banks or more aggressive selling of long-term Treasuries to raise mortgage rates faster than short-term (e.g. money market) rates that compete with bank deposits. Both alternative policy tools would have ostensibly decreased loans and tightened financial conditions without bankrupting the banks which are inherently in the business of borrowing short (deposits) and lending long.

The Fed will probably be able to rate cut aggressively to reflate in 2024 but that will be the last reflation with a disinflationary tailwind for the next several years, if the proxy war in Ukraine metastasizes into direct NATO conflict heading to WW3 in earnest from 2025 through 2027.

My comment:

1:01:48 Peter Schiff explains that eventually with runaway inflation expectations, the trapped Fed wouldn’t be able to reflate with QE as the signal it has been for the market to buy bonds expecting a profit— also especially and concomitantly when the dollar loses its flight-to-safety status. This is ostensibly why our overlords are preparing to force us onto CBDCs so that they can both control runaway inflation with centralized digital wallet enforced rationing (because price controls never worked) and to prevent any capital flight from the USD financial system.

Steven Van Metre explained that brokerage or money market accounts holding short-term Treasuries or directly accessing said Fed facilities (e.g. reverse repos), can thus pay higher interest rates on deposits sucking the extant deposits out of the smaller banks rendering the gutted banks insolvent. This consolidates the banking system.

Even if the above issue is resolved if FDIC insures all deposits at all banks over $250,000, the consolidation will continue because the pressure on depositors to move to higher yielding short-dated Treasuries via money market accounts which can directly access the Fed funds rate.

In other words, the Fed is simultaneously creating “emergency” liquidity while also hiking or holding rate high, which facilitates a (premeditated) consolidation-centralization of the banking system.

An astute person realizes all of the above have been ongoing. The normalcy bias that incoherently favors the anodyne belief that such an elaborate scheme could materialize without premeditation, as if by some chaotically emergent phenomenon of stupendously improbable coincidence, is thusly fooled by the deliberate red herring of Brandon administration’s “incompetency.”

That leaves me with the only possible conclusion that they KNEW what they were doing, and that this was DELIBERATE with the intention of creating World War III. — Martin Armstrong

The consequential liquefaction of bank assets from longer-dated Treasuries to overnight repos will increase volatility. Imagine when the Fed drops the funds rate as fast as they hiked it! That’s why I’ll be buying Bitcoin hand and fist at ~$9k in 2024 at the bottom of the looming bankpocalypse corona dump flash crash redux.

“During this new stage of the depression, the refugee gold and the foreign government reserve deposits were constantly driven by fear hither and yon over the world. We were to see currencies demoralized and governments embarrassed as fear drove the gold from one country to another. In fact, there was a mass of gold and short-term credit which behaved like a loose cannon on the deck of the world in a tempest-tossed era.” — Herbert Hoover, Memoirs, Volume II, Chapter 7, page 67

Operation Chokepoint 2.0, “Cover our ass” and/or Operation YCC?

Probably 25 basis point on March 22 as 50 would be too obvious. Yet Nic’s Operation Chokepoint 2.0 thesis is probably correct, although the motivation is manifold and expansive— I’ll circle back to that latter bit later in this section.

Presumably our overlords are at least but perhaps not soley primarily motivated by preempting any competition from (centralized USD) stablecoins they don’t control because historically virtual value transmission4 (and virtual, potentially anonymous liquidity providers and market makers) ostensibly being an existential threat to their fiefdom, not present in the in-person exchange of cash and gold. Precious metals dealers can be easily targeted and regulated. In-person exchange of gold (not at reputable dealers) is impractical and dangerous. Powell even equated stablecoins to money market funds. Ostensibly the stablecoins must be crippled before the FedNow instant transfer capability goes live in 2023.

My reaction to aforelinked video:

The issue with this is counter party risk. It’s not solving anything. They can easily abuse this by not having the digital asset not fully backed by the gold.

@CryptoFrog Exactly. I wrote...Nonsense. Kevin did you forget e-gold? [c.f. footnote ⁴ above] Physical backing just means the govt can seize it. This is a non-starter. If will be rife with failure such as when the backing is pilfered or confiscated. We tried this already in the 1800s and it resulted in fractional reserve banking. As for cash, it will be useless when the complicit major corporations refuse to accept it. The farmer won't take it because they can't buy their inputs from the corporations with it. And so on…

Just buy gold. Cut out all the middlemen.

@Talesfromthecrypto Can't transact over distance. Can't transact without warlords finding out you have it. Can't transact without the liquidity providing market markers who are easily targeted by the govt. Gold is dead. That is why Bitcoin was created. I used to be a gold and silver bug. I am smarter than that.

Where I live I Wichita falls tx. There are places now acceping gold as payment

@Damian Torres What is the spread? 15%? If you lose 15% of your value every time you spend, this doesn't work. Also this can be shutdown instantly by the Feds, because the only way those retailers can accept gold, is they reply on market makers to convert it to fiat for them so they can pay their expenses and replenish inventory. The Feds can target the market makers overnight. Do not delude yourself with this nonsense. Legacy protocol Bitcoin is the only unencumbered asset. Period.

My reaction:

Please! Crypto is safer than anything! Unless u have gold bricks under your floor! Government can’t touch it

@German Shepherd Daphne Channel Encumbered assets won’t cross the chasm. The only non-encumbered asset is legacy protocol Bitcoin. Note the current impostor Bitcoin will go “poof it’s gone.” I have explained this in great detail but nobody pays attention.

Maybe that's because whatever you just wrote didn't make sense. Want to try again?

@JT Thomas my statement makes perfect sense. Use your dictionary to look up the term encumbered. If you want to ask me about the why the 2017 soft fork created a 13 million Bitcoin booty “anyone can spend” then I will direct you to my About.

I will give you an example hint, so maybe you start to unpack the statement. Real estate is encumbered by its reliance of pulling income forward by 30 or 40 years with mortgages. Real estate is encumbered by soon-to-be bankrupt local governments with spending holes in their pockets (peak socialism and corruption) who will raise property taxes so high that people will run as far as they can from real estate. We are headed in a major clusterf*ck of epic proportions between now and 2032.

Gold is encumbered [for the aforementioned reasons].

@S. Moore I know exaclty what encumbered means. Your simply not making any points or sense. It's a rambling and that's why nobody is listening. I own and run multiple huge companies and still can't understand what your getting at. I'm not dumb... maybe you need to think about how to explain your message.

@JT Thomas what part of for example that the govt can seize real estate and block gold exchanges, but not decentralized crypto exchanges do you fail to grok?

https://twitter.com/shelbyhmooreiii/status/164744018213048729

(why the fuck is Substack not embedding Twitter links)

Meanwhile it appears that bluechip fintech, non-issuers of digital tokens and web3 companies of some significance will still find banking relationships, yet some perhaps even more flaky than the banks that just failed.

businesses that issue digital tokens are typically taboo. But other companies in the crypto world could still be accepted. “It really comes down to: ‘Are you primarily a crypto company? Is that your primary business? Are you exposing us to more volatility in some way?’” the person says.

ACH transfers between personal bank accounts and exchanges may still be functioning although these are sometimes flagged. Circle, Robinhood and other exchanges appear to still be banked for the uncertain duration meantime.

Although Congress is inquiring, FOIA requests have been submitted and the SCOTUS will hear a case on the consitutionality of the Fed’s Consumer Financial Protection Bureau (cfpb) which may be the implementing agency of Operation Chokepoint 2.0, the threat is synonymous with the Certificate Of Vassal IDentity power grab: that the progression will move faster than any governance can respond to rectify. Which also portends that radical acceleration might be looming.

Awarded routing number notwithstanding, the Kraken bank hopium seems bleak given the rejection of the Custodia, Protego and Paxos’ applications.

And perhaps most damagingly, the Fed’s devastating denial of Wyoming SPDI bank Custodia, as well as their policy statement, effectively ends any hopes that a state-chartered crypto bank might get access to the Federal Reserve system without submitting to FDIC oversight.

In the wake of the Custodia decision, obtaining a new charter for a crypto bank looks extremely unlikely. Banking innovations at the state level, like Wyoming’s SPDI for crypto banks, appear dead in the water. Federal Charters for crypto firms with the OCC also look dead in the water. Traders, liquid funds, and businesses with crypto working capital are nervously examining their stablecoin portfolios and fiat access points, wondering if bank connectivity might be severed with little notice.

Could the Fed’s lame justification have been fear that there would be too many banks that don’t issue loans?

Custodia was applying only for a Fed master account, which does not require FDIC insurance. The Fed provided no explanation as to why it required federal deposit insurance of Custodia.

More importantly, would deposit insurance be needed if the bank is 100% backed by highly liquid assets and does not make loans, as Custodia was proposing?

Finally, Fed Chair Jerome Powell remarked that if the Fed had approved Custodia, then the Fed would be flooded with similar bank applications, and then who would do the lending? Chair Powell’s fear is not listed as one of the reasons why Custodia’s application was denied, but it sounds like it may be an underlying cause. It seems premature to deny Custodia’s application on an unfounded fear that there would be a tidal wave of narrow bank applications.

Stimulate demand for long-term Treasuries

Perhaps not entirely lame after all but more of a side-show to the paramount goal. How to aggressively crater debt-driven demand side of inflation while not creating inflation when providing liquidity to backstop contagion, while also funding the exploding U.S. Treasury deficits? The more that war exacerbates supply chain destruction side of inflation, the more the demand side has to be strangled. Looming WW3 rationing enforced by CBDC? The alternative strategy of price controls didn’t work to contain inflation in the 1970s—didn’t work in Sri Lanka—they never work.

Usher in the innovation of the Fed’s shiny new BTFP (“buy the f-ing pullback/pivot/pause”) program to restructure Janet Yellen’s prior harebrained proposal for the Treasury to borrow short and lend long to one that traps savers in a negative real interest rate CBDC dragnet.

but suffice it to say, BTFP is Yield Curve Control (YCC) repackaged in a new, shiny, more palatable format. It is a very clever way to accomplish unlimited buying of government bonds, without actually having to buy them.

To fully understand why this BTFP program is so groundbreaking and ultimately destructive to savers […]

With the newly expanded BTFP, the Treasury can easily fund larger and larger USG deficits because the banks will always buy whatever is for sale. The banks don’t care what the price

is[will be] because they know the Fed has their back. A price sensitive investor who cared about real returns would scoff at buying more, and more, and more, and trillions of dollars more of USG-issued debt [but now they will have no choice as savers, unless they become speculators or get out]. The Congressional Budget Office estimates the 2023 fiscal deficit will be $1.4 trillion. The US is also fighting wars on multiple fronts: The War on Climate Change, The War Against Russia / China, and The [Peak Socialism] WarAgainst[For] Inflation. Wars [especially those that end globalism cutting off supply chains, and historically the maturing of baby boomers in 1970s] are inflationary, so expect the deficits to only go higher from here. But that is not a problem, because banks will buy all the bonds the foreigners (China & Japan, in particular) refuse to.

I reiterate this BTFP scheme will reduce lending (as would other less diabolical, alternative monetary policy tools such as increased reserve requirements) but with the added effects of centralizing the banking system and ultimately the entirely economy. And we are supposed to accept this is necessary so that the USGovt can continue to run massive, increasing deficits. Peak Socialism Always Moves to Tyranny.

There’s some limit to U.S. Treasury deficits banks can fund if their non-checking account depositors are fleeing never to come back again. Thus long-term bond interest rates will need to rise significantly. Yet if savers want to avail of those rates they will need to do so through a bank, because the bank will enable them to be liquid as the bank is protected by the BTFP against pricing risk for bonds not held to maturity. Thus the TBTF banks will become conduits for savers to tap the BTFD liquidity.

This allows the USG to run the same growth playbook that worked wonders for China, Japan, Taiwan, and South Korea. The government enacts policies that ensure savers earn less on their money than the nominal rate of GDP growth. The government can then re-industrialise by providing cheap credit to whatever sectors of the economy it wants to promote, and earn a profit. The “profit” helps the USG reduce its debt to GDP from 130% to something much more manageable. While everyone might cheer “Yay growth!”, in reality, the entire public is paying a stealth inflation tax at the rate of [Nominal GDP — Government Bond Yield].

Arthur Hayes is incorrect to equate this with Japan (at least not for the next few years) because Japan was trying to create inflation, not fight it. This diabolical BTFP plan enables the Fed to hold the Fed funds rate high to fight inflation, while creating zombie banks whose saving deposits flee to money market accounts to chase yield. Fed will cut rates only when the plummeting lending creates a recession, because inflation will remain sticky due to the said numerous “wars.”

And savers who are falling behind earning only negative real returns in even money markets will be tempted not to rotate back into bank deposits when rates fall, but instead to speculate into risk-on assets to ride the reflation bubble.

I don’t foresee any re-industrialization happening. The government can only misallocate resources. Investors will become speculators or exit the peak socialism clusterfuck. Thus I expect the continued decline of real GDP.

Once it becomes clear that there is no shame in tapping the BTFP, the fears of bank runs will evaporate.

There’s still uncertainty about whether FDIC will insure accounts over $250,000 at smaller, non-systemically important banks and delayed access to funds during a bank failure. Banks that need to access BTFP will be deemed distressed because they’re paying interest on their own capital. The last depositors remaining as others flee to money markets or risk-on bubbles, are at risk that the bank fails. BTFP is a Banks-to-The-Friggin-Purgatory, scorch-the-banks pogrom.

At that point, depositors will stop stuffing funds in TBTF banks like JPM and start withdrawing funds and buying money market funds (MMF) and US treasuries that mature in 2 years or less. Banks will not be able to lend money to businesses because their deposit base is chilling in the Fed’s reverse repo facility and short-term government bonds. This would be extremely recessionary for the US and every other country that enacts a similar program.

Government bond yields will fall across the board for a few reasons. Firstly, the fear of the entire US banking system having to sell their entire stock of USG debt to pay back depositors goes away. That removes an enormous amount of selling pressure in the bond market. Second, the market will start to price in deflation because the banking system cannot return to profitability (and thus create more loans) until short-term rates decline low enough that they can entice depositors back with rates that compete with the reverse repo facility and short-term treasuries.

I expect that either the Fed will recognise this outcome early and start cutting rates at its upcoming March meeting, or a nasty recession will force them to change tracks a few months from now.

EDIT: I predicted not and so far I’ve been correct as the Fed raised 25bp and signaled it will hold Fed funds rates high as long as necessary to crush inflation.

The 2-year treasury note’s yield has collapsed by over 100 basis points since the onset of the crisis. The market is screaming banking system-sponsored deflation, and the Fed will listen eventually.

The bond market somehow thinks the Fed will abandon fighting inflation in order to avert a hard landing. Instead the Fed is likely to wait for inflation to come below their funds rate before they cut.

A few months from now the instant bank transfer 24×7×365 FedNow will launch, which may facilitate and accelerate runs if the Fed has not cut rates sufficiently by then? Bank runs are ostensibly bullish for Bitcoin because they signal imminent release of more easing from the BTFP; and unlike stonks Bitcoin isn’t worried about declining earnings from tightening lending conditions, as it has none. The completed first wave of BTFP easing is already being redeposited at the Fed? We’ll see if it rushes back out to risk-on assets soon (which is what I expect short-term until the risk of recession heightens).

Under this new BTFP paradigm everyone must be tracked on a CBDC (cash must be limited, phased-out) so no one can mark-the-amok-fiat-system-to-market by exiting to a non-custodial assets (i.e. “not your keys, not your Bitcoin”, “not your physical, not your gold”) which preclude fractional reserves.

The Fed and US Treasury did not let a good crisis go to waste. They devised a truly elegant solution to solve a number of systemic issues. And the best part is, they get to blame mismanaged crypto- and tech-focused banks as the reason they had to step in and do something they would’ve had to do anyway.

Elegant or diabolical?

Get Out

The most frightening outcome for the Fed is if people move their capital out of the system. After guaranteeing deposits, the Fed doesn’t care if you move your money from SVB into a money market fund earning a higher rate. At least your capital is still purchasing government debt. But what if, instead, you bought an asset that is not controlled by the banking system?

Assets like gold, real estate, and (obviously) Bitcoin are not liabilities on someone else’s balance sheet. If the banking system goes bust, those assets still have value. But, those assets must be purchased in physical form.

You are not escaping the insidious wrath of inflation by purchasing an Exchange Traded Fund (ETF) that tracks the price of gold, real estate, or Bitcoin. All you are doing is investing in a liability of some member of the financial system. You own a claim, but if you try to cash in your chips, you will get back fiat toilet paper — and all you have done is pay fees to another fiduciary.

Speculation to amass more fiat toilet paper is still a valid activity for plebs who can spend it all, or if there’s a way to convert that fiat to a non-custodial asset. That’s why they need the CBDC to thwart capital flight. The resourceful will use front companies to move capital to more leniet jurisdictions and/or to buy tangible assets justified for business such as real estate. The non-extant unicorn of a gold mining stocks that pay dividends in-kind in gold would have performed very well at this juncture. Don’t be shocked if the stonks make new all-time highs.

For Western economies that are supposed to practise free market capitalism, it’s very hard to enact wide-ranging capital controls. It’s particularly difficult for the US, since the world uses the USD because it has an open capital account. Any outright ban on various means of exiting the system would be seen as an imposition of capital controls, and then there would be even less desire among sovereign nations to hold and use dollars.

Welcome to the multipolar world taking form. El Salvador adopted Bitcoin.

It is better when prisoners don’t recognise they are in a cage. Instead of outright banning certain financial assets, the government will likely encourage things like ETFs.

Be careful what you wish for. A true US-listed Bitcoin ETF would be a trojan horse. If such a fund were approved and it sucked in a meaningful supply of Bitcoin, it would actually help maintain the status quo rather than give financial freedom to the people.

Also, watch out for products through which you “purchase” Bitcoin, but cannot withdraw your “Bitcoin” to your own private wallet [e.g. Paypal and Fidelity]. If you can only enter and exit the product through the fiat banking system, then you have achieved nothing. You are just a fucking fee donkey.

There is obviously a place for fiat. Use it for what it’s good for. Spend fiat, save crypto.

Given rampant inflation threatening political, social and economic instability, weaker countries are threatened by adoption of USD stablecoins possibly displacing their sovereign national currencies. Thus countries with adequate mobile data penetration and coverage of most of the population are more likely to attempt to impose CBDCs to retain their national sovereignty. Contrast with Nigeria that has so far rejected CBDCs. It’s difficult to ban decentralized cash (or barter) in populations that are not debt-slaves (as in all developed nations) and with a significant percentage of self-sufficient, subsistence farmers.

Andrew Henderson who’s in the business of convincing people to diversify into multiple nations, takes the stance that countries outside the U.S. empire’s nexus (e.g. Non-Aligned Movement nations) have more incentive to innovate (e.g. into cryptocurrency). El Salvador adopted Bitcoin. Dubai and Hong Kong may be the next crypto friendly (banking) hubs after Singapore.

2:34, ~5:45, 8:20 & especially 9:35 for the key statement. The diabolical BlackRock CEO (at a recent globalist conference including Bill Clinton) was asking for a change to the IMF charter to put $trillions of capital into forcing ESG (new green climate crap) down the throat of the developing world. He said the current amount of capital applied there (~$100B) is far insufficient to “uplift” the developing world onto their panopticon plans.

Silvergate facilitated $425 million for S.American money launderers?

Marc Cohodes was exerting pressure on regulators by calling out subpoenaed evidence brought to light in the FTX debacle. Remember the Demonrats were allegedly employing FTX as a cover to funnel funding to Ukraine and fatten their campaign donations. Most people don’t know that unspent campaign donations don’t have to be refunded and are tax-free. A related example is the Clinton Foundation allegedly laundered non-profit funds to themselves via fake a Haiti charity and donations as investments where the Clintons held a beneficial interest.

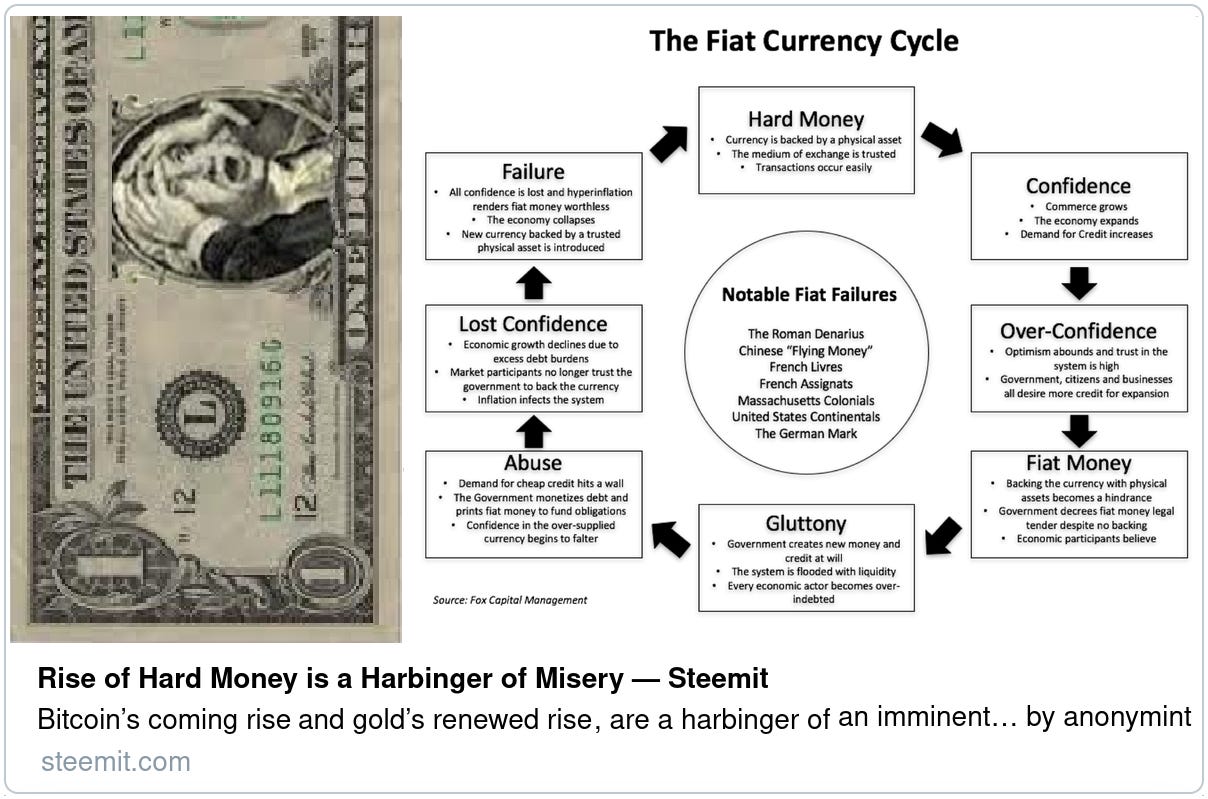

My model is that more powerful entities furthest behind the curtain are orchestrating a surreptitious, diabolical, horrific hyperdeflationary aka hyperbitcoinization NWO plan underway (which includes legacy protocol Bitcoin rising from the looming WW3 ashes). Are the entrapped henchmen mafia (e.g. at certain agencies within the Brandon administration) running scared because they don’t know who is pulling the puppet strings (i.e. covering their ass) and/or is there concerted effort among the USGovt oligarchy to marginalize crypto with and supplanted by FedCoin? My model is that the politicians, voting, legislatures, nation-states, sheeppl are deprecated by the plan of the said supreme sovereigns who are leveraging the said deprecated against each other (i.e. divide-and-conquer strategy) to usher in the NWO which will enslave the nation-states in famed mathematician John Nash’s diabolical Ideal Money variant of a two-tiered monetary system.

A crucially important thought experiment for my thesis to be correct is the supreme sovereigns have trapped the nation-state oligarchies (especially the USGovt empire) in such a Minsky Moment pickle that they’re forced to soon impose unbearable totalitarianism threatening financial devastation, which will unequivocally ignite a raging stampede Schelling point for the capital flight into the Bit(nir)vana hyperbitcoinization outcome. I’d name it Bit(dy)stopia though, because of the ruinous impacts of hyperdeflation and the two-tiered monetary regime of the looming ANYONECANSPEND restoration of 1 MiB limited blocks, legacy protocol Bitcoin (archived).

Curtis Yarvin didn’t (not even tacitly) acknowledge the shift underway to a multipolar world with the Thucydides trap WW3 looming circa 2025 through 2027. To entirely thwart black-market Bitcoin exchange, the USGovt would need to (for the first time in the dollar’s existence) to cancel the decentralized cash form of the dollar (40%, 60% or 70% of which circulates globally) although dollar cash is only 3% of the money supply. More saliently, no country will trust another’s centralized CBDC. Thus what will they use for a reserve currency and international settlement? Difficult to imagine in what form given the centralization of the banking system, although one might posit that non-retail dollar settlement could be a separate, decentralized system. Ultimately there can only be Bitcoin and as of 2025 it will be legal for banks to hold Bitcoin as reserves. That’s the essential insight into why Yarvin’s Bit(holo)caust won’t be the outcome.

To counteract the Streisand effect the government would need to establish a gestapo and entrapment operations to attempt to discourage people from exchanging their CBDC for crypto disquised as some service rendered. Crypto is more adopted by plebs than the wealthy. Besides Arthur Hayes’ point that the government is likely to allow Bitcoin derivative and fractional reserve products which sustain the speculative FOMO bubble.

However barter exchange fiat ramps won’t provide sufficient liquidity which is presumably why governments want to tightly control centralized stablecoins and exchanges. Yet the technology exists for decentralized exchanges and (an improvement on Rai/Dai) for a free-floating, purely algorithmic, fully decentralized, stablevalue cryptocurrency (stablecoin) that doesn’t rely on any centralized collateral peg. There’s some suspicion that the inventor of that key Rico design insight was suicided (c.f. also) just a couple of months after the Tornado.cash crackdown.

Bitstan, in fact, leaks money—not least because mining creates forced sellers

Gold miners sell also. Thus the stocks-to-flows and unforgeable costliness model of the Bitcoin value. Bitcoin is as physical (tangible) as gold if their respective cost of mining sets the marginal price for both. The digital gold Bitcoin’s hardware is orthogonal to the transmission of its value.

I posit the stock-to-flows model will become more applicable again when the looming ANYONECANSPEND event kicks the plebs off of Bitcoin so that it becomes more of a non-transactional, hodl, digital gold store-of-value such that the mining flows become a more prominent proportion.

Stage 2: “You’ll own nothing. And you’ll be happy”

Next flip the switch with a (cyberattack blamed on Russia and/or China?) false flag pretext so these consolidated-centralized deposits are bailed-in to the looming, totalitarian FedCoin coupled with pretexts (e.g. false flag cyberattack) for instituting anti-money laundering, capital controls to prevent capital from fleeing to permissionless financial systems such as decentralized cash, cryptocurrency and gold.

Ostensibly there’s a plan to further consolidate and/or collapse the banking system with increased capital requirements on banks with any exposure to commodities that would be impacted by climate change crisis emergencies— another potential looming false flag.🤯Government Gone Wild.🤡

Incipient examples of capital controls are underway such as the fines against Bitpay. Bitpay’s debit card is provided by Metropolitan which is shutting down. Bitpay is the payment provider for many of the offerings to buy gold with crypto. Some accept BTCPAY which enables merchants to deploy their own exchange account.

A comment on WHO planning new “pandemic treaty” for 2024:

What the cryptocracy are really orchestrating is pulling down the veil of faux sovereign nations and fake democracies, under the guise of fictional catastrophes, to insert the global, biometric ID, vax credentials, digital currency and social credit, slave system.

Under this system there will be forced medical treatment and forced vaccination. People’s bank accounts can be wiped or frozen, if they don’t get the next depop shot.

Once it’s automated, there’s no turning back. Once we can only purchase food using cards (how easy and dangerous was swiping and tapping??), can’t use cash, we are in an AI prison grid where an algorithm can literally decide who lives and who dies on a daily basis by switching off our ability to access to our money, jobs, food, fuel or shelter. There’s nowhere to run under this system. It’s global.

There are more faux pandemics planned. The temporary relaxing of the lockdowns, and vax passports is a ruse.

The banking-merchant-military cartel have the infrastructure in place where the SMART health card, already rolled out, will morph into your global digital, banking bio-ID.

All that needs to happen next is pull down the internet and the banking system. Once the internet goes down, they can claim they need everyone to sign onto the web using a certification system such as the Qcode on the SMART card or vax papers, or your credit card or Facebook, Apple, Google account to access the web.

Then once the banking system is pulled down in an orchestrated crisis; through a faux market crash or faux cyber pandemic, they can replace cash and currencies with the Central Bank Digital Currency, that links up your Health SMART Card and the Vaccine Credential Initiative.

The infrastructure has already been built. They have simply used the last two years to traumatize and indoctrinate people into complying with their planned, multiple depopulation mechanisms, economic warfare, and global land grab of all property and assets, through the digital technocratic slavery.

The Great Cull has been planned since the 1930’s. Before they orchestrated WWII. It isn’t a new plan.

Stage 3: BlackRock takes ownership of the United States, Inc.

An excerpt from BlackRock and Going Direct Reset:

The “novel” coronavirus pandemic marks the greatest turning point in U.S. monetary history since the creation of the Federal Reserve in 1913. In large measure, the “novel” coronavirus pandemic narrative serves as a convenient cover story that distracts from and even masks the Federal Reserve’s unprecedented maneuvers in 2020—maneuvers that happen to have been planned [by BlackRock] and discussed in August 2019 [with the Fed] some four months prior to the first mention of any “novel” virus in Wuhan, China.

BlackRock instructed the Fed to violate its ‘split circuit’ charter and create money in the actual stock markets (aka M2 or monetary base) but only for certain targeted beneficiaries such as BlackRock, instead of quarantining QE within the commercial bank reserves which is otherwise limited to stimulating the economy only through lowering of interest rates:

[…]

But there is something else about the Fed’s actions in 2020 that makes them independently remarkable in a truly breathtaking way: while the Fed insisted throughout this episode that the extraordinary actions it took were all emergency measures necessitated by the onset of an alleged virus pandemic beginning in December 2019 […] What’s more, this plan was presented to the Fed by BlackRock, which the Fed later appointed to assist the Fed in executing the $3.5 trillion plan. To put it bluntly, the actions taken by the Federal Reserve starting in March of 2020—actions that represented a massive departure from the Fed’s responses to crises before that time, as we have just seen—are exactly what BlackRock told the Fed to do in Jackson Hole, Wyoming over half a year before the World Health Organization (WHO) declared a pandemic.

[…]

In a nutshell, the arrival of the 2020 pandemic was about as accidental as an assassination. The pandemic narrative is nothing but a cover story to conceal from the public what in reality is the biggest asset transfer ever.

Maybe one could argue that the Fed was avoiding the zero or negative interest rate trap that befell the ECB. But this alternative concentrates all the wealth and thus control of the economy in crony entities. And they weren’t very transparent about it, even discontinuing the weekly M2 series in a public relations stunt to attempt to convince the public that the hockey stick M2 isn’t a concern.

I commented:

Martin Armstrong claims in his public blogs in 2020 and 2021 that the Fed was just returning to its original function of directly buying commercial paper, i.e. corporate debt. You may want to explain how this is different from that original function. Seems to me the key difference is that the non-bank financial entity (a corporation yet financial one which is not the spirit of the original Fed function) is not issuing debt but instead trading a debt-based asset for cash enabling it to inject that cash into specific investments that benefit cronies.

John Titus (also on Odysee) published an excellent video that explains the mechanism visually.

Even more damning Titus explained that the since 1971 the Fed has been violating the Federal Reserve Act which only allows it to create liabilities. The dollar was redeemable in gold before Nixon closed the gold window 50 years ago, which was the only form of dollars the Fed is authorized to create. When the Fed creates unbacked dollars out-of-thin-air this is equity known as seigniorage, but in a legal fiction the Fed books them as liabilities to pretend it’s in compliance with its charter. Yet bank money in the retail markets are liabilities of the commerical banks thus the Fed has no legal authority to ‘go direct’ to a CBDC without enabling legislation from Congress. This means MMT is illegal. Fed Chairman Jerome Powell ostensibly confirmed the problem of legality and observe in the video with Powell the tense nail-biting of “El Profesor Chiflado” Agustín Carstens, general manager of the Bank for International Settlements (BIS) who is one of the outspoken proponents of enslaving CBDCs.

Wow this is continuance of the scams such as looting the gold from Fort Knox carting it off to the Philippines (archived) at the beginning of the 20th century and (starting with the Civil War occupation) disbanding the legitimate State governments, illegimate [thus non-]ratification of (thus invalid) Constitutional admendments and fooling us into being claimed as vassals of the legal fiction United States, Inc. (archived) as the main goal of the 1865 Civil War—not for sole purpose of ending slavery which was just the convenient excuse. But wait if all the commercial bank reserves are being booked as liabilities instead of equity does that mean that when the Fed is liquidated that the commercial banks are going to receive all the assets which include Treasuries and (the financial weapon of mass destruction which BlackRock’s Larry Fink pioneered) mortgage backed securities (MBS)? So is the upcoming monetary reset going to make commercial banks the owners of most homes? And aren’t the depositors at the commercial banks such as the non-bank financial entities which comprise BlackRock able to liquidate the commercial banks and take all those assets? So will BlackRock soon own the entire U.S.? Would this ‘debt forgiveness’ be the aforementioned World Debt Reset pogrom? (archived) Is Titus also unwittingly explaining how the interlopers plan to “legally” keep the gold they stole from us? So is the plan to cause everyone to default on their mortgages then the debts will be forgiven in exchange for giving up all private property rights (i.e. everyone will rent everything they use in Klaus Schwab’s ‘you will own nothing and be happy’) and BlackRock et al will hold all the MBS.

The answer may be:

The records indicate that BlackRock has additionally functioned as an insurer for both the Federal Reserve and the IMF, and as these banks are bankrupted, Black Rock as the insurer becomes responsible for both their debts and their assets---functioning as a de facto bankruptcy Trustee, selling off assets to pay down debts, restructuring loans, ranking creditor interests, reviewing stock portfolios, selling some stocks, buying others, and so on.

[…]

So, short version, BlackRock now controls all the assets of both the US, Inc. and the USA, Inc. and thereby controls the economy and the monetary policy of this country and there is nothing standing in their way --- except a few pesky details, and they are:

The US, Inc. and the USA, Inc. (archived) have both violated national and international law via their practices and BlackRock, Inc. is subject to the same laws as an incorporated entity and is prohibited from acting as an accomplice to or a party profiting from the criminal activities of these corporations and their banks;

Those hired and subscribed under Oath to serve the people have instead oppressed, cheated, enslaved and betrayed them. They have taken the saying, ‘The master is the servant.’ and turned it on its head: ‘The servant is the master.’

And they have tried to excuse their actions by saying, ‘We are a corporation and can't be held accountable for our actions.’ Oh, yes, they can.

Moreover in what has been described as the cryptocracy, mafiacracy or mafiocracy, Titus explained and explained that as early as 2009 the Fed was already aware that to launch CBDCs they would effectively be taking over the function of the Treasury department and issuing equities which are backed by the full faith and credit of the U.S.. Ostensibly the entire ruse of the Fed has been the a long-range plan (archived) to privatize the U.S. government thus Armstrong’s criticism of the book The Creature from Jekyll Island is misguided, c.f. also.

A timeline of the months leading up and into the pLandemic implicate all the usual suspects plus there was insider selling and CEO resignations.

During the last financial crisis of 2007 to 2010, the Federal Reserve gave BlackRock no-bid contracts to manage the toxic assets held in three programs known as Maiden Lane, Maiden Lane II and Maiden Lane III.

[…]

Today, BlackRock has been selected in more no-bid contracts to be the sole buyer of corporate bonds and corporate bond ETFs for the Fed’s unprecedented $750 billion corporate bond buying program which will include both investment grade and junk-rated bonds […] BlackRock is being allowed by the Fed to buy its own corporate bond ETFs as part of the Fed program to prop up the corporate bond market.

[…]

To make matters even more egregious, the stimulus bill known as the CARES Act set aside $454 billion of taxpayers’ money to eat the losses in the bail out programs set up by the Fed. A total of $75 billion has been allocated to eat losses in the corporate bond-buying programs being managed by BlackRock.

[…]

This raises the question as to what extent BlackRock might be influencing stock market moves using federal employee money to buy futures on the Dow Jones Industrial Average or S&P 500.

[…]

Those calls and meetings included the following according to the BlackRock Transparency Project:

“More than 220 meetings and phone calls between BlackRock CEO Larry Fink and senior government officials; 98 meetings between Obama White House officials and BlackRock executives; 185 meetings and phone calls between senior BlackRock executives and Treasury Secretaries spanning the Bush and Obama Administrations; 37 meetings and phone calls between BlackRock and senior officials at the Federal Reserve.”

The contact logs reveal that between August 17, 2007 and December 27, 2007 (before the American public knew just how severe the financial crisis was) Larry Fink conversed with U.S. Treasury Secretary Hank Paulson 21 times – twice a day on multiple occasions.

Blackstone and BlackRock

Vade Retro Satana (@pope_head) tweeted (unrolled):

Okay lets start by examining the founders of Black Stone. Peter Peterson, aka Rock Rockson […] American investment banker who served as United States Secretary of Commerce from February 29, 1972, to February 1, 1973, under the Richard Nixon administration.

[…]

Peterson was instrumental in Nixons eventual decision to upend the Bretton Woods agreement. The severing of the U.S. dollar’s ties to gold. Since then, the world’s monetary system has consisted of (mostly) freely floating currencies.

[…]

and thus Peterson takes over the Council on Foreign Relations (CFR) from Rockefeller.

It’s our fault because we embraced their debt trap (archived) thus empowering the global elite with control over our money system (as explicated below) and thereby relinquishing control over our government. (archived) Now the ‘big swinging dick’ of the Great Harlot system has a stranglehold on the multitudes...

Is BlackRock’s Aladdin actually sentient and prescient (💩🙄 ), or is it just the “good fortune” that results from a monopoly where the game is rigged? It’s ostensibly not AI that’s providing the “success”, but instead a complete subsumption of the sovereignty of our government.

In the Bloomberg article Elon Musk and Cathie Wood Say Passive Investing Has Gone Too Far in Twitter, Elon Musk and Cathie Wood point out that the concentration of funds under management by BlackRock gives them too much influence over publicly traded corporations while depriving those investors’ of access to outperforming stocks before BlackRock buys in.

BlackRock and the Vanguard Group Own Big Pharma + Big Media + Big Tech + Travel Industry

[…]

Drug companies are driving

COVID-19[Certificate Of Vassal IDentity] responses — all of which, so far, have [provably] endangered rather than optimized public health — and mainstream media have been willing accomplices in spreading their propaganda, a [provably] false official narrative that leads the public astray and fosters fear based on lies.

[…]

BlackRock and Vanguard form a secret monopoly that own just about everything else you can think of too. In all, they have ownership in 1,600 American firms, which in 2015 had combined revenues of $9.1 trillion. When you add in the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms.

Vanguard is the largest shareholder of BlackRock. Vanguard itself, on the other hand, has a unique structure that makes its ownership more difficult to discern, but many of the oldest, richest families in the world can be linked to Vanguard funds.

As reported in the featured video:

“The stock of the world’s largest corporations are owned by the same institutional investors. They all own each other.

[…]

“Or, as George Carlin said, ‘It’s a

small[big] club and you ain’t in it.’” (archived)

[…]

“Wikipedia, again gives us the answer. They say that about 90% of the international media is owned by nine media conglomerates.”

[…]

“As you are watching millions fall into poverty because of the corona measures of the past year, even if the greatest economic crisis in history has not affected you yet, it will only be a matter of time until the rippling effects will hit you, as well.”

[…]

“Bloomberg calls BlackRock ‘The fourth branch of government’, because it’s the only private agency that closely works with the central banks.”

[…]

“To clarify the picture, I have to explain briefly what non-profits actually are. These appear to be the link between companies, politics and media. This conceals the conflicts of interests a bit. Non-profits, also called ‘foundations’ are dependent on donations they do not have to disclose who their donors are they can invest the money in the way they see fit and do not pay taxes”

[…]

“In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn, are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution.”

While it would take time to sift through all of Vanguard’s funds to identify individual shareholders, and therefore owners of Vanguard, a quick look-see suggests Rothschild Investment Corp. and the Edmond De Rothschild Holding are two such stakeholders.

[…]

The video above also identifies the Italian Orsini family, the American Bush family, the British Royal family, the du Pont family, the Morgans, Vanderbilts and Rockefellers, as Vanguard owners.

[…]

Considering BlackRock in 2018 announced that it has “social expectations” from the companies it invests in, its potential role as a central hub in the Great Reset (archived) and the “build back better” plan cannot be overlooked.

BlackRock CEO Larry Fink’s Family Tree Was A Mystery Until Now

So from all this digging we get a portrait of a the typical upwardly mobile Jewish family of the second half of the twentieth century. Where it diverges is where Larry and his brother get connected to the likes of Michael Milken, Lawrance Rockefeller, Larry Elison, the World Economic Forum, and the Council on Foreign Relations. Somehow the juice was provided to propel Lawrence Fink from a failed bond trader at First Boston to running a three trillion dollar investment firm with controlling interests in most major US corporations, that has been given extraordinary power and influence in engineering US financial policy—to the detriment of its own citizens.

Should we villify Larry Fink as a wolf-in-sheepskin or is he just a chirpy, innocuous, blameless capitalist seeking free-market profit?

Larry drinks his own Koolaid because he and our global elite have no other choice—they don’t want a free market economic collapse that would creatively destroy them with bottom-up rejuvenation so they must continue their top-down morass by any means no matter how dystopian. Larry ostensibly founded BlackRock to develop better investment uncertainty (aka risk) management ostensibly, as a reaction to his huge losses in his prior investment role. He probably sought an idiotic Holy Grail in AI but all he found that really works is to charge risk to the public backstop. Now he’s selling it as a some insight into social progress when in fact all these global elite are doing is attempting to “pretend and extend” to forestall the necessary economic collapse by strangling the free markets. The economic collapse is necessary because society is so maladapted (archived) to the $trillion debt bubble. Of course they will tell themselves that it’s not the case and they are the wiser ones who can lead us through a massive technological unemployment transformation as if technological advance (not be confused with the complicit, corrupt Big Tech) is the problem—which it’s not. Recently I expounded (in my Telegram group chat) on my 2013 essay about Kuzweil’s nonsensical A.I. Singularity thesis:

A.I. is a tool. And it can’t defeat human ingenuity. Upthread I had some posts about how dumb A.I. is because it only knows about what it has seen in its training regimen and its creativity is nil. Don’t be fooled with propaganda. The [analog] entropy of the human species can’t be captured digitally.

A.I. can mimic its training set. A.I. may hopefully defeat/fool some human stupidity and that culling (archived) is a desirable event for species resilience.

A.I. can not defeat human ingenuity. It is an issue of entropy. The analog entropy of humans is not quantifiable.

The arrogant attempt by humans to think they can digitize nature. I think someone (not you) forgot about the Heisenberg principle and Boehm’s hidden variables. Or quantum entanglement and quantum decoherence.

Yes they are retarded and will be culled and I argue that is good thing. Less of them and proportionally more of us.

We just have to figure out where to hide out in the interim.

What we don’t want to do is burn out our energy on (trying to stop, fix or prevent) the idiocy movement.

Power thrives on energy. (archived) We must withdraw/conserve all our energy.

Do Markets Like Totalitarian Governments?

“Markets like totalitarian governments”. It makes sense if by “markets” we really mean the collection of mega-wealthy managers and banks that control much of the world’s finance and money and then trade these paper obligations in the casinos and semi-rigged markets called “stock exchanges”, “funds”, and “banks”. The things that the media refer to when they say “the markets did such and such today”. It makes sense because such “investors” really crave certainty about the future and they abhor risk. Risk means uncertainty. In this sense totalitarian governments are a boon for such investors. Totalitarian governments are more predictable, more amenable to whatever the mega-investors desire, and more controlling.

[…]

For most of us regular folks, getting richer means producing more and more valuable goods and services for the market. But the reality is that for the very elite, very wealthy, it’s not really about how to produce more. First, wealth is relative. They already have most everything they can want in terms of goods and services. It’s now about status and ego. For that, absolute wealth is not important. Relative wealth is. And there’s two ways to increase your relative wealth: make yourself richer, or ensure that others get poorer. The other major objective of these very wealthy is protection of what they’ve got […] Of course, totalitarian governments in real-life tend to be very predictable for long stretches, but the end is always unexpected and unpredicted.

Agreed but there’s more to it than that. The masses are also invested in usury on the debtor and on the fixed income pension side. Usury being an insidious, exponentially invasive paradigm is eventually incompatible with free markets because it infects the entire society until it’s too big of a threat for the vested interests inertia to allow to fail.

Westerners protesting against the usury trap they laid in. (archived) Did they expect the outcome of their borrow-into-oblivion to be a bed of roses? Larry Fink is able to do what he does because everybody has a retirement investment account directly or via their pension! Duh.

The economy is bankrupt so our overlords deem they need to tag, track and control us so (← Larry & Carstens’ Excellent Pandemic) they can prevent uncertainties. They can enforce rationing and predatory taxation for example via some Chinese-like, but Western-style totalitarian social credit score. This will eventually end up in the direction of China’s ‘zero COVID’ insanity.

Make sure to also read the sections Insane Clusterfuck of the Collapse of Rule-of-law, Eventually to Imprison Most Westerners (archived) and Trillionaire Fund Manager Martin Armstrong Was Framed By Our Corrupt Government (steemit).

Related links:

Many people have written in asking why are all the government spending like there is no tomorrow? The answer is – there is no tomorrow! This Great Reset is all about defaulting on the national debts and so they are all going nuts spending whatever they like knowing that the end game is the default. There is no longer any pretense of fiscal management. Everything will simply vanish according to the forecasts of Klaus Schwab. This is also why they have been using COVID to enforce lockdowns and terrorize people […] All Western governments are moving as fast as they can to flood the economy so they can just force the fault and suppression of the people.

It’s also because they need a scapegoat to distract the sheeppl from the insolvency of the decades of kakistocracy, kleptocracy and gorging on debt by (especially Westerners and their) governments. 30 year mortgages (archived) pull income forward by 30 years thus making homies 30 times more expensive — only Rothschild wins and we all collectively shoot ourselves in the feet. Welcome to the insanity of democrazy and sheeppl civilization.

This entire scheme is because they can neither pay off the national debts nor can they fund the pensions. They know the system is collapsing. This is WHY Klaus Schwab was able to get his foot in the door. They knew the system would collapse. They have intended to end all rights to vote. In Europe, nobody in the European Commission stands for election. All laws are ONLY made by the Commission. They have succeeded in terminating democracy at the EU level. They have decided to burn down the barn and pretend it was someone else.

This entire Great Reset is the sales pitch to the younger generation, which glosses over the hard facts. Some people are saying there are two resets and call the other the “Direct Reset,” which seems to be a term they are trying to apply for the unspoken details of the Great Reset.

This is the highest increase since calculations ever began in 1962. In February, the rate was already high at 16.2% […] Our models are pointing to serious trouble ahead for Germany and this poking Russia is all intended as a diversion from the collapse of the European economy that is underway. The negative interest rates since 2014 have wiped out the pension funds and proven that the central bank can no longer control the economy. Add to that, the braindead COVID restrictions which have dealt a serious blow through the heart of the supply chain, and we have a recipe for total economic disaster which is being reflected in the inflation rates which then leads to civil unrest […] Germany appointing [conniving activist and child abuser] Jennifer Morgan in charge of [exploiting the malleable icon Greta Thunberg (who now says ‘shove your climate crisis up your ass’) to push] their [inane] environmental policies and the intent was to make her their Secretary of State is just astonishing […] These climate zealots have managed to destroy the world economy in just two years […] They should admire their heads in the mirror every day, for if history repeats, they will be dragged from their palaces and their heads might be adorning spikes with cheers of vindication […] Ever since COVID, we have witnessed a rising trend of civil unrest politicians have been working hard to deliberately create war with Russia all cloaked in their real objective of controlling the planet. Ever since this intended war to poke the Russian Bear, there’s been an acceleration of every conflicting agenda on the world stage.

I have never been one to yell fire in a crowded movie. But this is getting absolutely ridiculous. The global economy is in such a tailspin and there is nobody with a solution no less even a hint of what is developing so rapidly before everyone’s eyes, it appears just hopeless to save society.

The HYPERINFLATIONISTS, presume that government will continue to just print, for they cannot see that government is turning aggressive against the people for the bondholders will not tolerate such a policy and demand austerity with higher taxes. This is a Mammoth battle that is being waged and then they fail to grasp that state and local governments cannot print money and are becoming very Draconian raising taxes and prosecuting anything they can to raise money. The federal governments are not coming to the rescue of state and local

Great Clusterfuck?

Catherine Austin Fitts posits that the Titanic, totalitarian globalist plan will hit an iceberg of human nature:

Six months into the Covid-19 lockdowns, we have a world divided into a handful of players who can print currency versus the rest of the world—caught in the “mother” of all debt entrapments and left with sovereign bonds of questionable worth. Are we headed toward the “mother” of all debt/equity swaps, with taxpayers’ real estate and other assets on the hook? The private entity—BlackRock—that has been given free rein to reengineer the global economy (including “managing” vast sums of money for the Fed and various government pension funds), conveniently, is beyond the reach of FOIA or any other mechanism to ensure transparency.

[…]

The “magic virus” has managed to create a projected $500 billion deficit for U.S. state governments (an amount that matches up neatly to the increased wealth of U.S. billionaires), and Covid-19 is also being used as the advance cover story for an emptied-out Social Security Trust Fund later this decade. In addition, the push to get local police out of the way—against the wishes of at least 86% of Americans—is conveniently timed to make it easier for corporations to steamroll over local laws and reengineer places via Opportunity Zones. Thus far, mind control, entrainment, and divide-and-conquer appear to be working rather well—especially with the concurrent shuttering of churches and cultural institutions—but the hypermaterialist model never adequately accounts for the fact that all humans and all life have a spiritual component.

The globalists created a new church of disinformation, addiction, demoralization and virtue signaling. (archived) I suppose that’s what the Metaverse will be for to replace the emptiness that humans would sense if they weren’t otherwise totally addicted and consumed.

Unfortunately, Mr. Global has been busy mobilizing vast sums of taxpayer money to create a dangerous contact tracing army that will be empowered to enforce quarantines and seize children. The individuals promoting this agenda—ranging from the Queen of England to WHO officials to Epstein Air’s "frequent flyers"—are highly placed, and the American people need to face up to the risks. However, when you try to take away people’s children, you could be playing with fire.

Agreed Floridians are fighting back for example. And Americans are armed to the hilt. (archived)

The “Going Direct” plan—the central bankers’ push to preserve their global currency position by controlling everything directly without intermediaries—is not subtle. In the short term, Covid-19 has helped Mr. Global put the small-business economy and most of the planet into a debt trap while increasing key corporations’ market share. However, we need to remember that the new system is “in the invention room.” Many variables are at play, and many factors—including cyberwarfare and the “Midianite thing”—could interfere with the creepy plan to manage seven billion people with cloud-based injectable credit cards.

Is she positing that nations and corporations will sabotage each other’s satellites?

Building out a global financial mechanism means not only controlling the sea lanes but controlling space, which includes not just satellites but weaponry. The problem with space is that it is “winner-take-all”—the player who dominates space can control everything on the planet […] From the perspective of those outside the U.S., a major problem is that the U.S. is not “agreement capable.”

[…]

There are many signs that the space race is heating up, including Japan’s talk about space-based "rod of God" weaponry and India’s continued launching of large numbers of satellites. In the U.S., contrary to most other countries, the private sector is the dominant player in space, which gives the corporations a lot of power.

In the video A walk with Catherine Austin Fitts | Planet Lockdown, she pontificates that the globalists such as BlackRock want to build a prison planet not a human civilization, which is counter to laws of nature. She posits in the light of transparency they’ll backstab each other as did the Midianites in the biblical story of Gideon.

I mostly agree but with an important quibble or point of clarification. She is describing the bizarre abject chaos ahead. This is the end of the sixth 309.6 year wave. (archived) There will be war, fighting, struggle and collateral damage everywhere and in many facets of life. BlackRock will harvest those defaulted mortgages (as MBS) that she alludes to. Eventually a new bedrock is reached and we-the-awake rebuild ex nihilo. There is already the Bitcoin escape valve frontier for the faction of human nature (i.e. the global village of the awake that Fitts mentions in her video) that is capable of rejecting the CBDCs. Bitcoin ultimately leads to the end game of Revelation (by 2050 or 2100+?) but in the interim it will be the fulcrum on said bedrock. Yet most of humanity is not capable of resisting and have ostensibly lost their soul already, so I expect they will embrace the CBDCs. Remember most people need to be lead by priests. Who will those priests be if not our globalists? Indeed the battle is spiritual. This is the coming Great Bifurcation—those with and without a soul. To have a soul one must at least understand everything written in this Gist. Empathetic, high IQ individuals such as Fitts probably have a bias to underestimate how vapid, apathetic and incapable of abstraction most people are, because it comes so effortlessly to the mentally adept that it’s damn near impossible to imagine how difficult it is for most people to think. Literally from experience I being (only) Mensa-level confirmed that within 3 minutes of reasonably straightforward verbiage will induce mental exhaustion (and a nap) in a midwit repeatedly without exception. I’ve read that typically a gap or two or three standard deviations (SD) in IQ is an insurmountable gap in communication range, in which the less adept will distrust the more adept, perceiving them as whacko, little green people speaking gibberish.

Where is the empire in Fitts’ prognosis? Human civilization requires empire. (archived) And in a multipolar world with the chaos of mutually assured destruction of space assets the empire can only be a globalist NWO.

Fitts is correct (as stated in her video) that the technology has changed and our village-of-the-awake synergy is geographically distributed over the globe, thus precious metals are deprecated. And thus in most cases we’re outnumbered politically in any physical jurisdiction such as in terms of home confiscation via taxation, Civil Asset Forfeiture, eminent domain—thus my conclusion to boondock. Florida may be an option for civilization at least until the chaos of the looming economic collapse. Our enslavers’ trump cards and the Achilles heel of Ron DeSantis might include rigging elections, importing migrants and moreover the number of voters that will be surviving on UBI doled out by CBDCs, at which point the politics and economics of Florida may crack and/or segregate with gentrification? Perhaps this strategic need to bankrupt Westerners explains why our overlords are cultivating maximum stagflation with medical terrorism (even in China and Russia) and intentionally provoked international war in Ukraine which is the first domino in cascade of geopolitical-economics that end up in WW3. And our NWO overlords have a diabolical plan to kick the plebs off of Bitcoin and imprison us in a two-tier monetary system. Fitts seems to not appreciate the critical importance of monetary economies-of-scale and the impoverishment that would accompany any barter or physical local scale money system.

Despite my nostalgic, bucolic, retrophiliac, Water sign romance with the terrestrial beauty of life on Earth, I appreciate the insight of Fitts’ point that our overlords are preparing humanity for an interplanetary system. Thus Earth needs a global government to represent it in the future extraterrestrial federation. And transhumanism is probably necessary for time travel and other ostensibly multiverse feats of the purported UFOs that seem to defy classical physics. The recent UFO propaganda may also be intentional H. G. Wellsian demoralization, to prep for false-flags and/or a Wellsian scapegoat applied to Fitts’ looming war in space.

Humans that don’t meaningfully contribute to the technological leap ahead into an intergalactic species may be deprecated in the theory of power perspective, as they no longer have any harvestable economic purpose other than as fodder in the machinations required to proceed to the next stage of human evolution.

I replied to the proposal for secession:

And when the seniors lose their Medicaid/Social Security, state citizens are banned from the U.S. dollar financial system and from travel to the other states, banks stop loaning to Floridastan, interest rates skyrocket to 18%, mortgage market collapses, etc? The southern states tried to secede preceding the Civil War and were militarily defeated. Is Floridastan’s military any match for the U.S. Air Force and nukes?

No state can unhitch until the abject collective collapse is worse than the alternative, which is projecting several decades out from now.

I replied in the affirmative:

Indeed the U.S. is not in the stage of its cycle wherein the vested interests of various sectors of the populace have sufficient incentive for a full power restart—both secession and full power restart are onanistic fantasy. Russia was at that stage when Putin seized power after the IMF’s entrapment of Yeltsin. Russia isn’t a dynamic enough juggernaut to resist the globalist NWO empire which is rising to supplant the U.S. empire and whose theory-of-power raison d’être will include restoring order to the multipolar power vacuum and forthcoming war in satellite space.

Whereas upwards of 15% of the colonists fought in the Revolutionary War—not the oft-claimed 3%.

“That rebellion to tyrants is obedience to God.” — Benjamin Franklin

This distills to the generative essence of why without effective decentralization technology, civilization is doomed to (repeated cycles of) elite capture collapse which some might equate to biblical Revelation end times. Power vacuum collectives can only be captured by the most adeptly Machiavellian (even at obfuscating their power, e.g. in institutions) and revolutionary. Only the sociopathic power unconstrained to any adherence to humanitarian virtue is free to project the most power; thus, ruthless acquisition of power is the only centralized defense against centralized power. Machiavellian elite exist because any extant power (vacuum) waits to be (re-)taken (away) as flies to honey, because otherwise “if you can’t beat them, join them” [aka genuflect to them, c.f. also]. Ignoring politics isn’t possible except for leaderless organization wherein system participants are permissionlessly, substitute-good whack-a-mole targets.

My reaction:

I'm Chinese and I found this heartwarming, sadly reality won't let this happen forever

@Malaysian Mapping sadly the power vacuum of the collective demands capture by the most ruthless. It's not Xi’s fault that ruling the power vacuum requires the capture of power. If we want to change humanity, we have to find a way to eliminate the power vacuum. That is why I delved deep into block chain technology starting with my conversations with the likes of Charles Hoskinson and Daniel Larimer on bitcointalk in 2013 before they became publicly well known. Unfortunately there's some deep flaws in the technology as it currently stands.

C.f. footnote #1 above.

The Fed’s was ostensibly induced to delay by the very low labor participation rate, which of course was intentionally created by all the free handouts and the plandemic which encourage workers (especially mothers) to stay home (as they were forced to home school in many cases).

Inserted the section: Silvergate facilitated $425 million for S.American money launderers?

https://anonymint.substack.com/p/coercing-the-dystopian-fedcoin#%C2%A7silvergate-facilitated-million-for-samerican-money-launderers